|

Insights

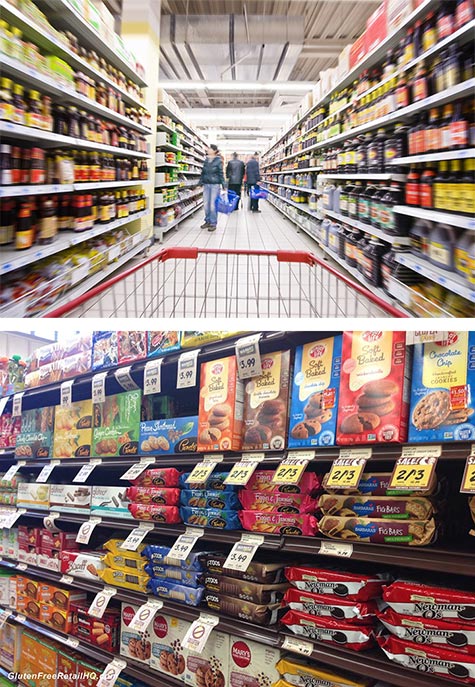

Most of us would agree that over the past twenty years the lion's share of the focus and creativity within the supermarket has occurred on the perimeter of store. This is true for a number of reasons. Retailers have deliberately placed their fresh foods departments on the perimeter to be close to prep rooms and refrigeration. In addition, the majority of the store's best deals reside on end cap displays on the back and front aisles of the store. This all made a lot of sense until it was discovered that over time, fewer and fewer shoppers were entering the "center" area of the store and consequently, the categories and items found in this forgotten area were beginning to suffer from the resulting under exposure. Understandably, for the past decade or more, retailers and their brand partners have frantically worked to devise new incentives to lure the shopper from their current behavior of remaining on the perimeter to venture down the long and arduous aisles of Center Store. Some of their efforts have paid dividends, but despite new "intrusive" signage, fixtures and fixture configurations, Center Store is still very much under siege. While gains in Dairy, Frozen and Salty Snacks are encouraging, the majority of the remaining Center Store categories have seen sharp decreases in unit sales and in some cases as much as three to five percent over the past five years* Further, the driving forces behind Center Store decline are largely out of the control of bricks and mortar retailers. For example;

This downward trend of Center Store performance begs several questions, chief among them is "Can Center Store survive without radical changes?" If you believe as many do that the answer is an emphatic "NO", then the next logical question must focus on what should and what can be done. The true transformation of Center Store should begin with an honest assessment of the controllable factors that are contributing to its diminished shopper relevance. From the shopper's view, research and intuition tell us that today's Center Store presents a number of negative issues;

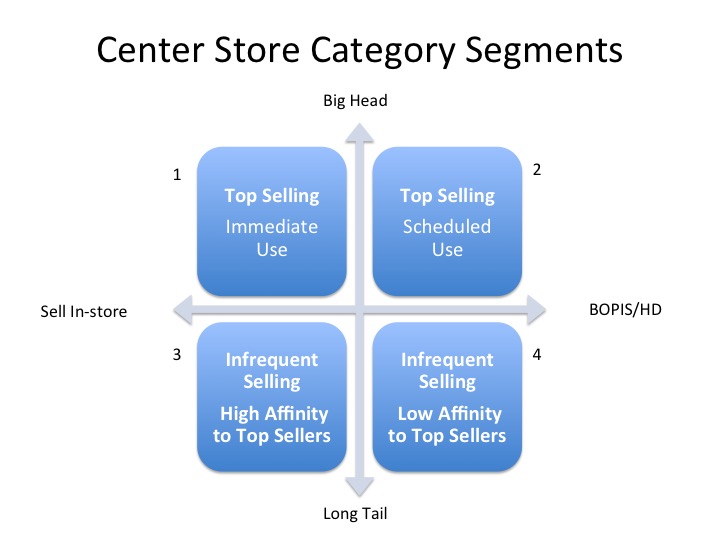

From the shopper's perspective the entire physical concept of 'Center Store" is becoming 'unnatural' when compared to their experiences either on-line or in smaller specialty stores. Most recent remedial solutions for Center Store deal with making ad hoc changes to category variety, new fixtures, additional signs and of late, new technology such as in-aisle digital engagement through mobile devices. Few if any however, deal with seriously re-thinking the entire concept of Center Store. Re-categorize According to How Shoppers Buy Any serious improvement to Center Store must involve the mitigating of the four aforementioned negative attributes. A logical first step in that process involves a re-categorization of Center Store, from the contemporary shopper's perspective. The adjacent chart depicts four quadrants of Center Store items that reflect current shopper behavior and options.

Where to Put What As monumental of an endeavor as the re-categorization of the Center Store will be for bricks and mortar retailers, dealing with the size and configuration of Center Store will even be a larger challenge. Of those leading bricks and mortar food retailers, some are designing and building smaller formats. Within these smaller stores, the process of re-thinking which items are kept and which is discarded is critical.

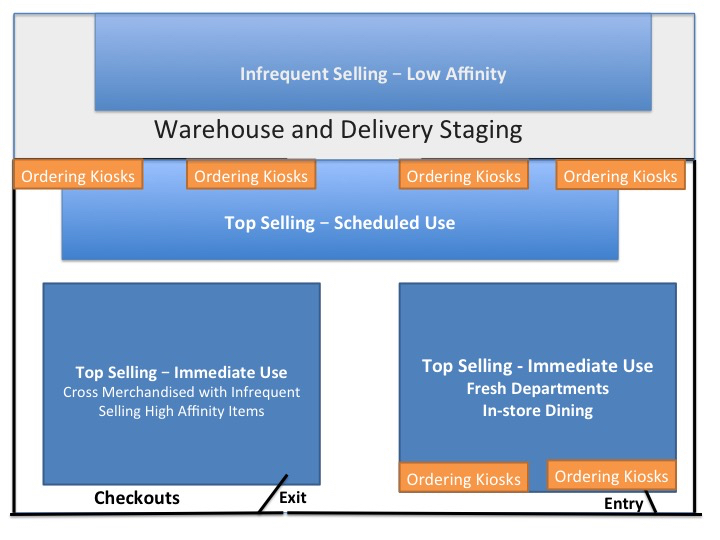

The adjacent graphic illustrates the beginning of the re-organization of Center Store. Notice that each of the four Center Store Quadrants are contained within this layout as well as multiple opportunities for shoppers to pre-order in-store for immediate consumption or simply pick up to take home. As monumental of an endeavor as the re-categorization of the Center Store will be for bricks and mortar retailers, dealing with the size and configuration of Center Store will even be a larger challenge. Of those leading bricks and mortar food retailers, some are designing and building smaller formats. Within these smaller stores, the process of re-thinking which items are kept and which is discarded is critical. What is also note worthy is the placement of Top Selling-Immediate Use items positioned where shoppers can more easily access them coupled with the placement of Top Selling-Scheduled Use items being available closer to the kiosks where they can also be ordered for regular delivery. As opposed to long aisles with multiple categories, this approach compartmentalizes items according to their relevance to the shopper and how they would likely prioritize placing them into their shopping cart. With this approach there is no 'racetrack' around the store's perimeter, but rather a natural flow from one shopping 'priority' area to the next. Perhaps the most critical aspect of this approach is the tangible merging of Center Store with On-line. While reducing inventory and clutter, the retailer offers the shopper an easy and practical means to access additional items via kiosks for either same trip pick up or delivery to the home or office. Shopper Logic

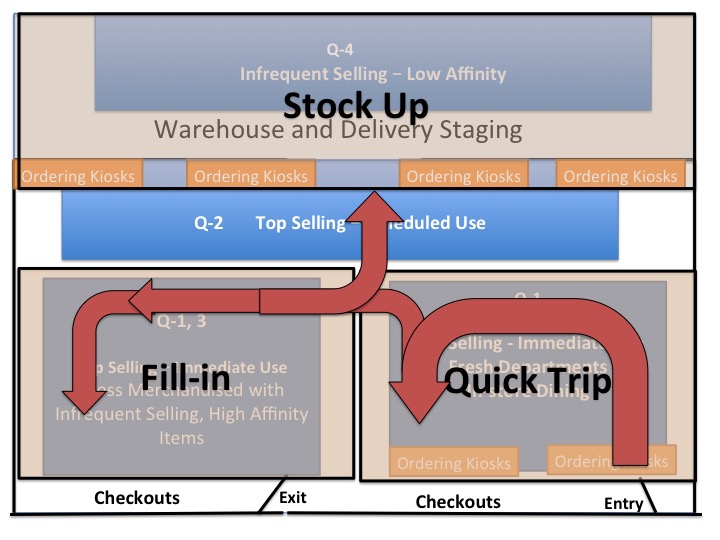

Finally, this new configuration of Center Store categories also serves the needs of traditional types of shopping trips, Quick Trip, Fill-In, Stock Up. Contrary to most current supermarket layouts, this approach facilitates a quick trip when one is warranted, but also efficiently accommodates larger trip sizes when shopper's needs change. Any approach to keeping Center Store categories viable within the bricks and mortar store must be in context to the many options of convenient alternatives now available to shoppers. While very basic, this approach represents leveraging shopper behavior data to re-think and reconfigure a vital part of the supermarket that most would agree is in need of updating and in a way that actually makes sense for the shopper. * 2015, Nielsen Category Trend Report Contributed by Mark Heckman, CEO - Accelerated Merchandising, LLC. Mark is a retail industry veteran that leverages over 25 years of executive level experience based in retail marketing, brand partnerships, category management practices and consumer research. Mark has worked with a number of highly reputable organizations within the retail supermarket industry. He has served as Director of Marketing Research at Marsh Supermarkets, VP of Marketing for Randall's Food Markets, MARC Advertising, and Valassis Relationship Marketing Systems. Mark has previously served as both member and chairman of the Food Marketing Institute's Consumer Research Committee and is currently the CEO of Accelerated Merchandising, LLC. a research-based merchandising company co-founded with Dr. Herb Sorensen. Connect with Mark Heckman or Accelerated Merchandising. |