The Incredibly Shrinking (In-Store) "Audience"

Shoppers in a store are NOT an "audience."

The title here is not intended to refer to any shrinkage in size of the in-store crowd of shoppers. It refers to our progressive understanding (EG) of the size of the "audience" that the crowd constitutes, that has emerged, particularly over the past decade. During that time, a series of empirical generalizations (EG,) has finally led to the enunciation of the principle that shoppers in a store are NOT an audience. This summary empirical generalization is justified because it accurately explains the diminutive facts about shoppers in the store, without erroneously attributing to them the typical characteristics of an audience.

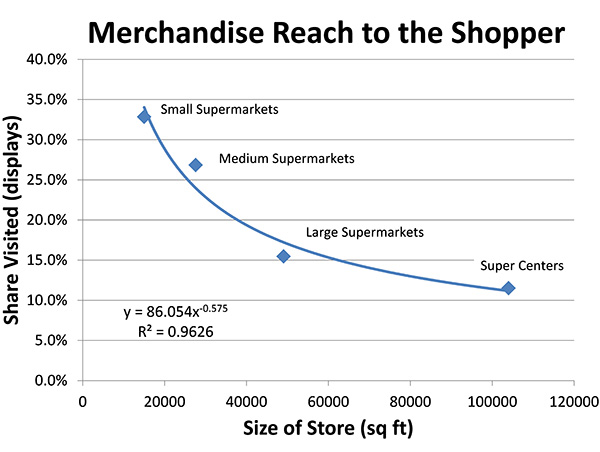

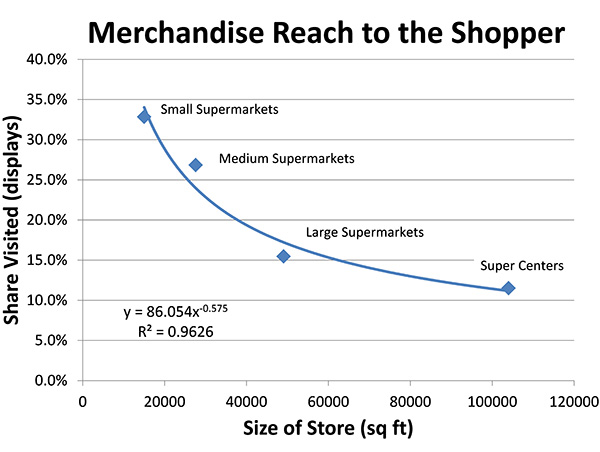

EG 1: Shoppers typically visit only a small portion of any store they shop. The larger the store, the lower the percentage of the store that is shopped by the average shopper.

In order to reach shoppers in a store, it is essential that the product display or media intersect the shopper on their path through the store. Measuring the actual paths of hundreds of thousands of shoppers in a typical neighborhood supermarket revealed that the "average" shopper actually covered about 25% of the store, with some areas visited by only a few percent of shoppers. (Sorensen, The Science of Shopping, 2003) This 25% figure effectively shrinks the reach of shoppers by the store, as a whole, by a factor of four, on average. However, the average share of the store visited varies considerably across the range of convenience stores, drug stores, supermarkets, mass merchants and super-centers, in every case, more shoppers enter the store to purchase only a single item, than any other number. In fact, for supermarkets, half the shoppers purchase only 5 or fewer items, making these coverage figures "reasonable," given the very large inefficiency of the shopping process. (Sorensen, 2009) (Sam K. Hui, 2008)

The numbers reported here apply to typical stores with a "warehouse" or grid design, that is, wherein half or more of the store consists of a series of aisles, typical of these types of stores. However, there are high efficiency stores where shoppers are constrained to a single serpentine aisle in which every shopper is exposed to nearly all of the merchandise in the store. (Saunders, 1917) One notable example is Stew Leonard's in the New York/Connecticut area; and IKEA takes a similar approach, globally. (Leonard, 2009)

We can conclude then that, at a minimum, counting all the shoppers who visit stores, as any kind of estimate of the media reach of those stores, is a gross and unwarranted exaggeration. David Polinchock, chairman of Brand Experience Lab, foresaw just such potential exaggeration when he noted about the Wal-MartTV network:

"There are just so many competing agendas among the retailers and big brands," he said. "Let's say, when you look at what PRN says, that they have 140 million viewers a week in their stores... What if this study showed that they really only have 2 million engaged viewers?" (Polinchock, 2006)

EG 1 does not address the engagement of the viewers, but shows clearly the fallacy in relating store traffic to audience size. EG 2 begins in a small way to address the issue of engagement, which is more fully addressed in EG 3.

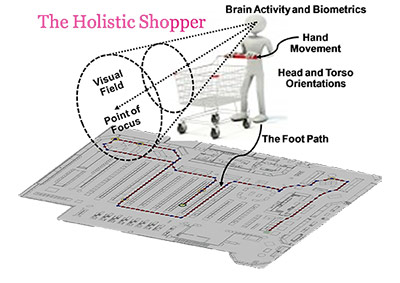

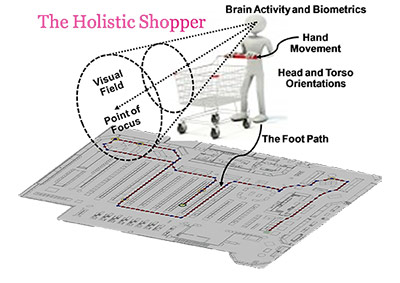

EG 2: For in-store media to engage a shopper, it must appear within their field of vision, which is a small fraction of all the fields visible from all the points that the shopper visits.

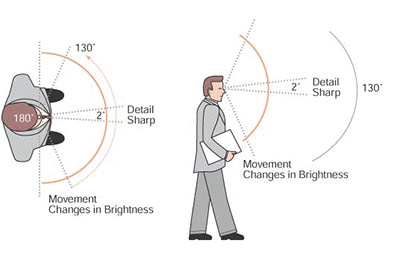

There is an obvious relation between the path a shopper walks, and what they see (their field of view.) This can be described as "the eye-bone is connected to the foot-bone" principle. The correlation of the shopper's path with their field of view is illustrated in this diagram of the holistic shopper:

Imputing the shopper's field of view from their foot path allows computation of the probable fields of view of all shoppers, integrated over all trips, and the full store. (Sorensen, 2008) One essential feature of these computations is that they incorporate the orientation of the shopper, as well as the orientation of the display, its distance from the shopper, as well as the seconds that elapse during exposure. Orientation also means that media that occurs behind the shopper, no matter how near, is not credited as having any impact, for example. The net result is that any given display is seen by and impacts only a small fraction of those whose paths come within sight distance of the display. (Alan Penn at the University College London has shown that bots respond to open visual space in a mathematical model in a manner very similar to how shoppers behave in a retail environment, suggesting that space is more important than merchandise in guiding shoppers around the store. But also, Penn's work is essentially a modeling of "the eye-bone is connected to the foot-bone" principle.) (Penn, 2011)

Imputing the shopper's field of view from their foot path allows computation of the probable fields of view of all shoppers, integrated over all trips, and the full store. (Sorensen, 2008) One essential feature of these computations is that they incorporate the orientation of the shopper, as well as the orientation of the display, its distance from the shopper, as well as the seconds that elapse during exposure. Orientation also means that media that occurs behind the shopper, no matter how near, is not credited as having any impact, for example. The net result is that any given display is seen by and impacts only a small fraction of those whose paths come within sight distance of the display. (Alan Penn at the University College London has shown that bots respond to open visual space in a mathematical model in a manner very similar to how shoppers behave in a retail environment, suggesting that space is more important than merchandise in guiding shoppers around the store. But also, Penn's work is essentially a modeling of "the eye-bone is connected to the foot-bone" principle.) (Penn, 2011)

Actual measurement of the field of view confirmed the big head/long tail nature of the field of view, validating the computed probable fields of view. (Sorensen, 2008) (These measurements involve laborious cataloging by technicians viewing video of the shoppers' views. In future, this process will likely be

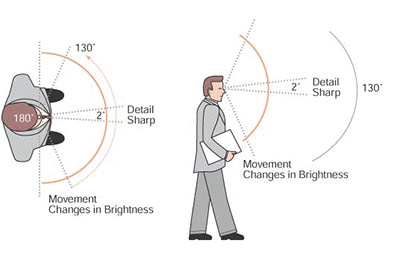

automated. (Sorensen, 2009)) [The automation process is being pursued in collaboration with Hyperlayer.] It is easier to catalog exactly what the shopper sees in the store, than to compare it to all that they do not see. However, given that peripheral vision, horizontally, is about 180°, with the most

significant impact being within, approximately, a 130° cone, the audience size reduction due to less than full store exposure cited in EG 1, is further constrained by this second factor of about one third - 130°/360° ≈ 1/3. (Janis Sugden, 2006)

The net result of the force of these first two empirical generalizations is that any estimate of an in-store "audience" in excess of one twelfth (1/4 x 1/3) of the store traffic is likely a radical exaggeration. (In fact for super-center size stores the exaggeration is likely by a factor of thirty: 1/10 x 1/3 = 1/30.)

significant impact being within, approximately, a 130° cone, the audience size reduction due to less than full store exposure cited in EG 1, is further constrained by this second factor of about one third - 130°/360° ≈ 1/3. (Janis Sugden, 2006)

The net result of the force of these first two empirical generalizations is that any estimate of an in-store "audience" in excess of one twelfth (1/4 x 1/3) of the store traffic is likely a radical exaggeration. (In fact for super-center size stores the exaggeration is likely by a factor of thirty: 1/10 x 1/3 = 1/30.)

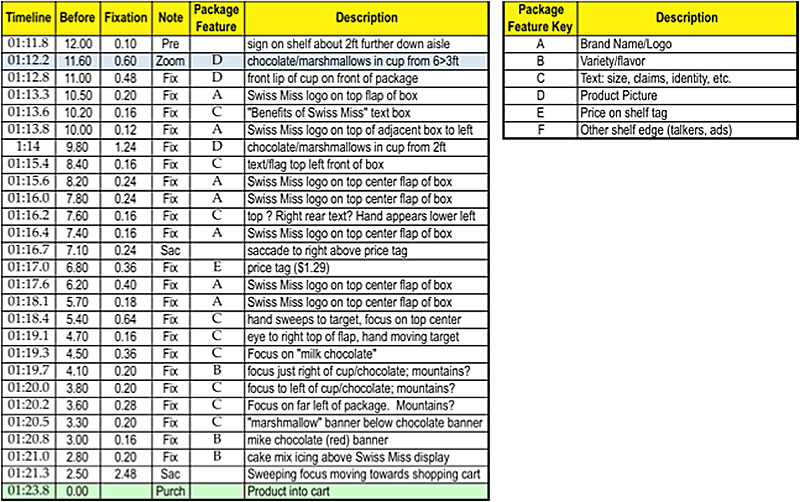

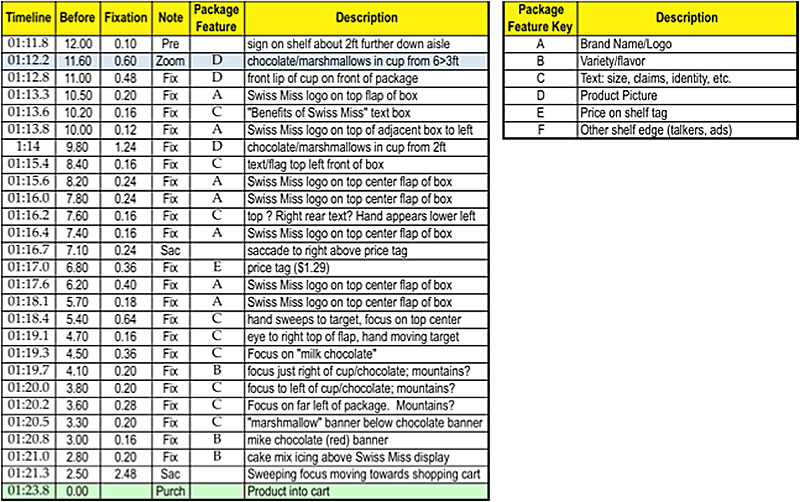

EG 3: Shoppers' engagement with what they see is evidenced by their fixation on features, which typically constitute less than 1/5,000 of their field of view. Shoppers fixations are so incoherent, that any vestige of an audience (defined as a group, receiving communication) dissolves into individuality.

Extending the vision measurements to the exact point of focus of the eye, the point of maximum mental engagement, more accurately catalogs the relationship of all displays/media in the store, which, in turn, is a small fraction of the full field of vision (about 1/4000 of the full field of vision (2° ÷ 130°)2 ≈ 0.024%.)

In order to really understand how shoppers relate to the visual stimuli in their presence, it is necessary to virtually see through their eyes, rather than ostensibly seeing what they are seeing through your own eyes. That is, there is an irreplaceable objectifying that occurs when studying eye track video that is not possible by imagining what you are seeing yourself. Because of your own vision and interpretive apparatus, it is impossible to have an objective view of what others are seeing, without actually looking through their own eyes. Thus, eye tracking video is the practical means of seeing not only what a shopper sees (their field of view;) but studying their exact point of visual focus - and the continuing changes in both as shopping occurs. Some idea of what this amounts to can be assessed by viewing a systematic series of still images over the course of a shopper navigating to, locking onto a display and finally selecting the exact item for purchase.

The beginning scene at the upper left shows the shopper's cart (lower left of the photo,) pushing past the endcap, as she glances to her right and downward (red crosshairs,) where a fraction of a second earlier she was focusing nearer the top of the endcap. Five seconds later she has turned into the aisle, focus just clearing the cart and trending to the left where she must navigate past another shopper already in the aisle. Her purchase will occur down the aisle a ways, on the left past the SmartSource coupon dispenser, but Special K is not yet readily visible. In another five seconds her focus is on the opposite side of the aisle. In fact, while navigating, there is a fair amount of this "ping-pong" bouncing of the point of focus from side to side. (Following this process on a 0.1 second by 0.1 second basis clearly demonstrates that the visual process must be under autonomic control, to an extent, subconscious.)

Four seconds later, the shopper has turned to her left, and is approaching the product she will ultimately purchase, but does not touch it for a full four seconds, glancing about the shelf. And then the product is off the shelf on its way into the shopping cart.

Similar 10-50 second sequences dominate the shopping process, lots of moving about, navigation, a lesser amount of engagement with displays, and typically, a few decisive seconds to consummate the purchase. One single purchase is catalogued here:

Before drawing the necessary conclusions, it is helpful to have some understanding of the point of focus and field of vision, and how they are controlled.

The point of focus actively moves about every tenth of a second. This flitting motion is necessary because of the physicochemical structure of the eye. The "film" on the back of the eyeball (retina) is sensitive to light rays because of arrays of pigments, much as in old-style camera film, or of some electronic screens. This means that continuous exposure will result in "burning in" of the image, if seen continuously. The eye avoids this easily demonstrable burning-in phenomena by rapidly and autonomically moving the point of focus. The speed of the movement is so rapid that it is quite impossible to be solely controlled by conscious selection of target points of focus. (Duchowski, 2007)

The field of vision is also transient, but to a much lesser extent than the point of focus. A huge component of the shifting field of vision is the near continuous movement of the shopper. The "eye bone is connected to the foot bone" principle means that for the most part, the field of vision will be defined by where the foot is carrying the eye, with some limited range of change of head and eye orientation. In fact, both foot path and eye path (field and focus,) are significantly controlled by the shopper's autopilot. (Martin, 2008)

Tame vs. Wild Audiences

It will be helpful, before drawing our final conclusions about the in-store audience, to think about the holistic experiences of various audiences. For that purpose, consider this illustration:

In the upper left, as an illustration, we see a humorous scene from a 30 second John West commercial for salmon, and below that, scenes of TV and web audiences. Those audiences are clearly oriented to their screens, by which the advertiser wishes to reach them, and are uni-directionally fixated on those screens before them. We refer to such audiences as "coherent" audiences, because the members of the audience tend to cohere, or stick together, all oriented in the same direction, and more or less giving attention to the content. At the same time, the audience is typically in a private, safe environment. All this can be subsumed under the term the "tame" audience.

On the upper right we are looking through the shopper's eyes for a similar 30 second in-store clip, seeing the scene the shopper sees, and focusing on a flitting point of focus, in autopilot mode. The near continuous lateral movement of the shopper, and rotation of up to 360°, creates an "incoherency" of what remains of an "audience" in the in-store environment. (Sorensen, 2011) Here the shopper is immersed in the media environment, much like a primitive passing through a jungle. (Changizi, 2009) Hence, the audience here is subsumed under the term "wild." The incoherency refers to the audience, not the message the advertiser might hope to give. That is, the audience does not cohere, or hold together, as a proper audience might.

Reviewing the shrinking audience, if a superstore chain has 140 million shoppers per week, this means that statistically, the "average" display in that store will only reach (be physically near,) about 14 million shoppers. Of these 14 million, perhaps 5 million will have the display pass through their field of vision. And this might result in 1000 shoppers actually focusing on the display. Thus, the 140 million shoppers is potentially reduced to 1000 engaged shoppers! "Engagement" here is being credited to many relationships that may last only a tenth of a second, up to a few seconds. Hence, the generalization that, in-store shoppers do not constitute a proper "audience."

Caveats and Clarifications

The single most important caveat related to this account is that it addresses the shopping crowd, and averages across the total store. This is an important perspective, to encourage realism in thinking about the diminutive impact of typical in-store media. But it is also true that averages poorly represent the in-store shopping experience. For example, in a store with 50,000 distinct items (each is a single point of "media,") half those items, 50% or 25,000, may constitute 5% of total store sales. At the same time, another 5% of those items may constitute as much as a third of the total store sales.

Since products and packaging are media, too, this big head/long tail phenomenon is directly relevant to measurements of media reach and effectiveness. (Sorensen, 2008) That is, some media may effectively play a role in accelerating sales in the big head, where it really matters. But simply deploying it where the traffic occurs is no guarantee of effectiveness: it is not uncommon for displays to have their back side facing the majority of oncoming shoppers.

For the in-store marketer, there are at least three further points needed in order to understand why many billions of dollars have been poorly invested in addressing shoppers in the store, and the way forward:

- nearly all "validation" of the effectiveness of in-store media is commercially, not scientifically based. That is, the proprietary owners of stores and their agents derive the major share of their revenue, not from selling to shoppers, but from tariffs on their suppliers. (Terbeek, 1999) (Sorensen, 2009) Further, they control, mostly, any measurement of the value of their property and shoppers. Any measurement of that value that diminishes the stated value will obviously be unacceptable to retailers and their agents. Look to business structure to account for lack of understanding of shopper behavior in stores.

- The value of traditional in-store media, though perhaps a fraction of what might be desired, may be significant on a relative basis. That is, if brand A has an extensive in-store media program, and brand B does not, the weak effect of the media may move the needle at least modestly. Moreover, given the small number of sales, per store, of specific items, it is possible to generate multiples of sales through targeted offers. Most importantly, stores are already jammed with efforts to communicate with shoppers. Perhaps there are shoppers who feel the need for a good shouting at, but most respond to the quiet whispers of habit: color, shape, symbols, etc. (Martin, 2008) (Whisper, Don't Shout (or mumble!)) It has been said that "Cinema should make you forget you are sitting in a theater." It's a useful perspective on selling in a store, where a less raucous and a more "cinematic" approach may be effective. (Leonard, 2009)

- Most of the shrinkage of the size of the "audience," detailed above addresses the traditional store with its traditional media (including digital) deployment. It does not apply to the rapidly developing personal media that the shopper carries with them on their shopping trip, whether attached to the shopping cart, provided by a hand-held proprietary device, or delivered on the shopper's own smart phone. These devices create some coherence of the audience, in terms of time relevance, orientation and one-to-one, personal communication. This is part of the increasing relevance of online marketing in the bricks-and-mortar world. (Jakob Nielsen, 2009) We are in the early stages of a Convergence of Online, Mobile and Bricks-and-mortar (COMB) retailing. All of which will lead to more objective, scientific measurement of both the audience and its response to the media.

Bibliography

Changizi, M. (2009). The Vision Revolution. Dallas, TX 75206: BenBella Books, Inc.

Duchowski, A. (2007). Eye Tracking Methodology: Theory and Practice. London: Springer Verlag.

Jakob Nielsen, K. P. (2009). Eyetracking Web Usability. Berkeley, CA 94710: New Riders.

Janis Sugden, L. R. (2006, May 5). Functional Assessment of Vision. Retrieved from Scottish Sensory Centre: http://www.ssc.education.ed.ac.uk/courses/vi&multi/vmay06c.html

Leonard, S. (2009). Stew Leonard: My Story. Colle & Co.

Martin, N. (2008). Habit: The 95% of Behavior Marketers Ignore. Upper Saddle River, NJ 07458: Pearson Education, Inc.

Penn, A. (2011). Who enjoys shopping in IKEA? Retrieved July 20,2012, from YouTube.com: http://www.youtube.com/watch?v=NkePRXxH9D4

Polinchock, D. (2006, June 12). P&G, Wal-Mart Opt Out of In-Store Advertising Study. Advertising Age , June 12.

Sam K. Hui, P. F. (2008, January 1). The Traveling Salesman Goes Shopping: The Systematic Deviations of Grocery Paths from TSP-Optimality. Retrieved from Social Science Research Network: http://ssrn.com/abstract=942570

Saunders, C. (1917). Patent No. 1,242,872. United States of America.

Sorensen, H. (2009). Patent No. Application 20090271251. United States.

Sorensen, H. (2011). Incoherent In-Store Audience. Retrieved February 27, 2011, from YouTube.com: http://www.youtube.com/watch?v=Ikjb_PambZo

Sorensen, H. (2009). Inside the Mind of the Shopper. Upper Saddle River, New Jersey 07458: Wharton School Publishing.

Sorensen, H. (2008). Long Tail Media in the Store. Journal of Advertising Research , 329-338.

Sorensen, H. (2003). The Science of Shopping. Marketing Research 15 , 30-35.

Terbeek, G. (1999). Agentry Agenda. Chesterfield, VA 23832: American Book Company.

Imputing the shopper's field of view from their foot path allows computation of the probable fields of view of all shoppers, integrated over all trips, and the full store. (

Imputing the shopper's field of view from their foot path allows computation of the probable fields of view of all shoppers, integrated over all trips, and the full store. ( significant impact being within, approximately, a 130° cone, the audience size reduction due to less than full store exposure cited in EG 1, is further constrained by this second factor of about one third - 130°/360° ≈ 1/3. (

significant impact being within, approximately, a 130° cone, the audience size reduction due to less than full store exposure cited in EG 1, is further constrained by this second factor of about one third - 130°/360° ≈ 1/3. (