The first great challenge of retailing

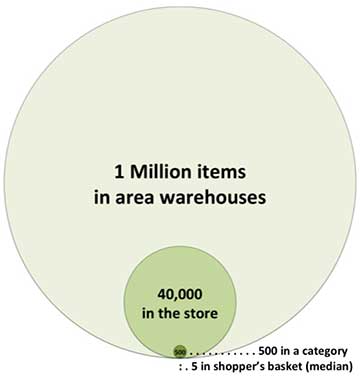

With the growth and prosperity of free markets over the past 100 years, a plethora of merchandise has been developed by a very large number of suppliers, hoping to reach shoppers and fill at least some part of their voracious needs and wants. The glut of merchandise options is so great, that in most major metro areas, the warehouses in that area have in stock for ready delivery to stores a million or more items ("Stock Keeping Units" - SKUs to the trade.) This is the first great challenge for any retailer: which of those million items to offer in their store(s)?

But that is only the beginning response to the full challenge, which is illustrated here:

The challenge here is, how to get from the one million available items to the five that the "typical" shopper puts in their basket? (The "5" is discussed below.) Going from a million to 40,000 items in the store is a huge step for the retailer, but getting from that 40,000 to the five is the primary challenge for the shopper. For the brand supplier, the challenge is simply getting as many of their own items into the 40,000 as the first in a two step process.

Retailers and Brands Manage Categories; Shoppers Buy Items

Whatever the number of items in the store, the retailer must have some organizational plan for arranging/managing their merchandising. Arranging items by category makes sense. But defining categories is neither simple, nor inconsequential. After all, you can organize everything into 30 categories, 80 categories or 150 or more. Category definitions are not written in stone, nor do they necessarily mean the same thing to the retailers, brands and shoppers.

The problem is well illustrated by the "juice" category, which in nearly all stores becomes as many as four categories. Bottled, canned and powdered juice are dry groceries, frozen juice is in the frozen food section, refrigerated juices in dairy, and freshly squeezed (and sometimes "natural,") in or near produce. This is the usual organizational structure, although some stores have experimented with putting all juices in a single location to help shoppers deal with the "juice category." Putting all "beverages" into a single aisle or section is another approach to making the category more sensible for the shopper.

This illustration of the four usual "juice" categories contrasted with the alternate single juice category, or a beverage aisle (category,) reflects the stark difference between the retailer's needs for managing operations with different forms of juice (shelf-stable, frozen, refrigerated or fresh,) with those of shoppers, who are more likely to be focused on filling a meal menu. The result is that the usual juice organization in stores is driven more by store operational needs, than by the needs of the shopper. The alternative experimentations ("single location" or "beverage aisle") are driven by marketing thinking, (trying to get closer to the needs of the shopper,) rather than by operational thinking, doing what works best for the store - that is, the store management and staff. In general, the mind-set of store management is very different from the mindset of shoppers. Not surprisingly, store management thinking dominates the store - not shopper thinking.

Twenty years ago, the strategy for management of stores widely moved to category management, CatMan to the trade. Just as 80 years earlier, when self-service retailing yielded massive benefits for shoppers, retailers and their brand suppliers, so CatMan yielded another wave of massive benefits for shoppers, retailers and brands. However, just as with self-service, CatMan retailing is driven more by the perspective (and operational needs) of retailers and brands than it is driven by the needs of shoppers. Both are permeated by a "pile it high, and let it fly" mentality.

Let's begin with the observation that the retail problem is massively simplified by reducing from one million to maybe 40,000 items in the store. And then the problem is further massively simplified by reducing those 40,000 items to 80 categories with 500 items each (typical). So a category is a bite-size management chunk. And typically, the number of brands involved in a category is relatively small, with two or three brands dominating the category. This arrangement vastly facilitates the retailer's challenge, because now they can more effectively integrate the brands' knowledge and expertise for managing the category, with the retailer only needing to coordinate, supervise (and overlay their own interests) on what becomes "the brand on brand gladiatorial contest" in the aisle.

But here would be a good place to point out that brands necessarily have very narrow and parochial interests in the store. The bottom line is that stores are built and managed for super efficiency in meeting the needs of retailers and their suppliers, with the presumption that the self-service shopper has all that they could need to satisfy themselves from the category managed store.

The problem is that no shopper has EVER, in the history of the world, purchased a category. SHOPPERS DO NOT BUY CATEGORIES, THEY BUY ITEMS!!!

In our diagram above, we show that the "typical" shopper buys 5 items from the total store. Views readers should be well aware that the number of items purchased is a power function, with half of the shoppers buying 5 or fewer items, and half buying 6 or more. (See, for example, "Deciding What to SELL!" and "How to Sell the Few, Among the Many?") We've been shouting these facts from the housetop for years, with limited effect in the retailer and brand world. The reason for this apparent retail obtuseness is very simple: mostly, retailers and brands get as far as category management which is founded on their own self-interest, and that of there dominant retailer partners, but does NOT include the dominant interest of shoppers: which single item here should I buy?

What we want to show is that item management, the next big thing in retailing, has a shopper centric focus, not so much focusing on the shopper, but focusing on what the shopper is focusing on. I hope that this distinction does not elude you, because it is worth a vast fortune. ;-)

The foundation of true selling at retail

So... let's turn that decrescendo illustrated above into another useful perspective on the exact same set of facts:

At first it was very important to understand the massive shrinkage of the offering from what suppliers have produced (one million) to meet the needs and wants of shoppers (five.) Now it is important to see this as, instead of shrinkage, as a massive foundation for meeting the needs and wants of shoppers. And just as the massive foundation and infrastructure of your home (plumbing, electrical, etc.,) serves you well, that foundation and infrastructure is NOT what the home is about to the user.

Looked at from this foundational perspective we see that category management is imperative in managing a store with tens of thousands of items. Simply put, stores with those numbers of items require some form of organization to get within striking distance of the shopper making purchases. At the same time, category management does not go the final mile in reaching the shopper.

The problem in the store is that the store does a very poor job of focusing on what the shopper focuses on there. It would be more accurate to say that the store does a very poor job of promoting just what the shopper wants to buy. I do not use the bastardized meaning of "promoting" where "promotion" means cutting the price, essentially paying the shopper to buy something. (An issue that is larger than the space we have for it here.) Suffice it to say that there is no need to pay shoppers to buy what they really want to buy. Instead, most stores offer a vast smorgasbord, with their bastardized "promotions" focusing more on what they and their suppliers want to sell, than on what shoppers want to buy. For a store, a few hundred items drive total store sales, because those few hundred specific items massively fill the needs and desires of the shoppers. For a category, a dozen or fewer items play the same role. And for a brand there are a few items that dominate what shoppers want. Managing distinctly, and promoting distinctly these items that constitute tiny fractions of the whole is what leads to outsize sales and profits. This is what Item Management, the next big thing in retail, is all about.

I like to think of it as a dinner party in that fine home mentioned above. A great dinner party has as one component a careful selection of the menu by the host. A great deal of thought will be given to the particular tastes of the guests, and perhaps they will be offered limited choices. The kitchen and pantry will probably have a lot more in stock than the guests are offered for the dinner. Seeing the parallel at retail, most stores simply usher their guests into the pantry and let them shift for themselves. It's nothing like the party that it could be - and I'm not talking about prepared foods - but matching what you promote (in the true sense) to the inmost needs and desires of the customer. It's in the transaction log. The exact record of what individual shoppers buy, across thousands of shoppers, also reveals the focus of the crowd on a relatively few number of specific items for the store, for the category and for the brand.

The final conclusion is that item management is an over-lay which builds on the foundation of category management. The need for item management is the need to actually sell something to the shopper, rather than to simply set up a display, in the hopes that shoppers will buy something, or anything here.

Summary

The major points that I hope you got from this are:

- Shopper's individual purchases are the result of a selection funnel that begins with huge numbers of items, which are funneled down to only a few items.

- Retailers and brands manage the huge shrinkage down to the category level, but are very ineffective in assisting shoppers with that final selection - managing the tip of the funnel.

- Rather than dealing with the vast shrinkage problem, shoppers build on the foundation of category management to make their own few final choices.

- The net result of those thousands of choices by the crowd, result in a few specific items that deliver outsize sales results. Item management is about selling by focus on those few items - offering those few as the menu for the "dinner party," without eliminating the pantry. The pantry (store) contains tens of thousands of low selling items in the store.

Here's to GREAT "Shopping!"

Your friend, Herb Sorensen