Bucketing Shopping/Purchasing

There is a sense in which every single purchase, of every single item, by every single shopper, is a unique event, distinct from every other purchase. To understand these global trillions of unique events, annually, we look for similarities so that we can group them into something smaller than trillions of buckets. In this Views, I am boiling down the trillions of unique events into three simple buckets. And although a great deal of statistical research has gone into these ideas, this is not strictly a scientific, mathematical segmentation. So I will refer to it as my purchase states hypothesis.

The Routine/Autopilot State

The first and largest shopping state must be the Routine/Autopilot State. When you buy something over and over again, in time it becomes a habitual process. When this happens, there is a shift from the shopper consciously thinking about the purchase, to an autopilot state that will efficiently make the purchase, without giving it a thought. It is this "over and over again" purchasing that Neale Martin refers to as "the 95% of behavior that marketers ignore."

Everyone got direct experience with this habit forming process by learning to tie their shoes. The first few times you tied your shoes, it was a laborious, thought-fraught process, as you concentrated on, "now cross the laces like this... then that one goes around so..." and so forth. But after some number of times, the knowledge of how to do this moved from a series of steps consciously executed by the fingers under the direction of the brain, to the fingers, having learned how to do it without guidance. The knowledge has essentially moved from the brain to the fingers, where it is really needed. The net effect of this striking increase in efficiency, is a resulting increase in speed. Faster sales mean more sales!!!

So just how many purchases does it to take to habituate all, or part, of a purchase. If you have purchased 10 computers over 20 years, has any part of the process become habitual? Maybe the brand? The retail source? Peripheral devices?

How about orange juice, purchased twice a month for the past ten years? Or shoes, maybe purchased several times a year?

I don't know the specific answers to all these questions, but I do know that the habitual purchase plays a huge and dominant role in convenience stores, drug stores, supermarkets and supercenters around the world. Consider: the typical household purchases only 300-400 distinct items in an entire year. Half of those, 150-200, they buy regularly (habitually,) week in and week out, over the year. The other half are purchased irregularly - some we'll discuss below. In any event, trying to communicate with a shopper on autopilot is a tricky business. As often as not, the brand manager grabbing the shopper's attention is interfering with the autopilot purchase of the brand's own product, and possibly not effectively communicating with the autopilots programmed for other, competitive products.

Here is one example of excellent management of autopilot purchasing:

Notice the position of the two words, "Campbell's" and "Soup", in 1895. Two years later the redesigned label introduced a tomato-red color, but lost the Campbell's brand. One year later the red moved up, the brand was re-inserted and a quality indicia was stamped right in the middle. Then, in 1900, the visual appearance became essentially what it is today, 111 years later. Question: How many habitual minds around the world recognize Campbell's soup, without bothering the shopper's conscious, executive mind? How much Campbell's soup finds its way into shopping baskets around the world, largely on autopilot? Of course it is a delicate process, that can be impacted favorably or unfavorably by small or large tweaks. (Alphabetizing the soup display reduced sales but the gravity feed dispenser accelerated them.)

Several major marketing disasters, widely reported, over the past few decades, essentially confirm the accuracy of Neale Martin's observation about the "95% of behavior that marketers ignore." Here is some further confirmation of the driving force of habit:

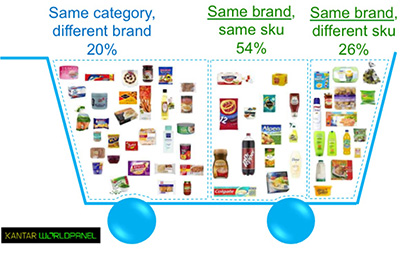

This Kantar WorldPanel data shows that on subsequent shopping trips, 80% of the time the shopper buys either the exact same item on the next trip, or perhaps a different variety of the same brand, while 20% of the time they may purchase a different brand from that category. A recent issue of the Views gives more detail on this subject in, "How to Sell the Few, Among the Many?"

The Surprise/Delight State

Now that we have discussed the reality of the dominant form of purchase of trillions of annual purchases, we turn our attention to what wishful thinking would like the dominant state to be: Surprise/Delight. There are some obvious examples of the Surprise/Delight State: You find out that the new car you were expecting to pay $35,000 for, is available for $29,000. Or you have been looking for just the perfect outfit for an upcoming party, and there it is! Or you simply don't have time to prepare the dessert you wanted to, and coming around the corner of an aisle, you spot something that solves that problem for you.

Obviously, Surprise/Delight is a worthy marketing objective. But think about this a bit. Of your own last 10 purchases (be sure to include the soft drink from the C-store) how many of them were "surprise/delight" for you? I don't have specific numbers on this, but if you are doing regular shopping, it is hard to imagine surprise/delight constituting more than a few percent of your purchases.

There is one HUGE problem with retailers attempting to surprise/delight their shoppers: almost invariably, the retailer instinctively turns to price as the tool of choice. And this problem is compounded by two factors:

- They intend to use the brand supplier's money to surprise/delight the retailer's customer. Further, like the little boy hitting his sister with his rope as he swings it about, and says to his mother, "she likes it!" the retailer says the brand manager "likes" it.

- Secondly, the shoppers mostly are NOT surprised and delighted. As Glen Terbeek reported in "Agentry Agenda," half the shoppers buying on promotion were unaware that the price was marked down, and half of those who were aware, didn't care anything about the reduced price.

The misuse of price in misguided efforts to surprise/delight is quite typical of the insensitive efforts of retailers. Any technique that shows the slightest positive effect, will usually be seriously overused, with the result of diluting or destroying any possible positive effect. For further discussion of pricing issues, see the economic analysis by Huang and Dawes of the Ehrenberg-Bass Institute, Report 43, "Price Promotions, How much volume is discounted that you would sell anyway at the normal price?" Also, for a balanced discussion of the role of price in promotions, see "Mind Your Pricing Cues," by Anderson and Simester in the Harvard Business Review.

Abusive, ineffective efforts to achieve the Surprise/Delight State should not discourage properly targeted efforts to actually surprise or delight shoppers. For example, the vast majority of a category's purchases may be habitual. But there could be a subcategory of, for example, special occasion items, where shoppers are more open to new products - willing to investigate and browse, using the executive mind. In fact, "new" is an entire marketing strategy that can be effectively used to break through the habit-filter. However, overuse, or not delivering on the claim, will reduce effectiveness of the technique, over time.

The Frustration State

The term "frustration" may be a bit strong for this state, although the "search/drudgery/occasional" state is often afflicted with frustration. First of all, simply finding something that you might buy every two years may be a chore, unless you are in the habit of seeing it regularly, even though you don't buy it regularly. For example, you need shoe laces, a piece of luggage that is "just right," or maybe a sauce that you can't figure out how the store has it classified, for display purposes. Not to mention buying a house or other major, rare purchase.

Again, I have no specific numbers as to the frequency, but my own shopping experience suggest that the Frustration State is a lot more common than the Surprise/Delight State. In fact, since I don't do most of the routine shopping for our household, these latter two states may constitute a larger share for me than for many other shoppers with more routine shopping experience.

Summary

Now for some comment on why all this is important. First, the previous issue of the Views pointed out that as valuable and essential as category management is to managing stores, it falls well short of addressing the item purchases of shoppers. (See The Dinner Party in the Pantry.) That is, there is a great gulf between retailers, brand suppliers and the shoppers they presume to serve. As I have often pointed out, shoppers do NOT purchase categories, they purchase individual items. Nor do "trip missions" adequately account for the diversity of experiences a shopper may have on any given trip.

By focusing on these three purchase states related to items, I have recognized the diversity that may occur from purchase to purchase, on a single trip. This is by no means the only way to classify individual purchases. I'm particularly thinking of the phenomena of licensing, whereby shoppers who have purchased "meritorious" products (healthy, green or otherwise) may feel they have accumulated sufficient "excess merit" to give them license to buy some less worthy product, like candy or ice cream.

These three states also illuminate some of the issues in the continuing evolution of retailing across online, mobile and bricks-and-mortar. Although online can deliver some surprise/delight, it seems like bricks-and-mortar may always have an advantage in this area. The emotional, immediate experience in the "real" world would seem to give the advantage to the physical store. However, in terms of search, especially for unfamiliar items in "the long tail," it's hard to see how the bricks-and-mortar store will be able to compete, without a HUGE inventory, and shopper electronic search capabilites – smart phones, for example.

This leaves the routine/autopilot purchase as a real battleground between bricks and clicks. Automating routine purchases is a potential winner for the online store. However, bear in mind that surprise/delight may seriously alleviate the drudgery or blandness of the routine in the bricks store. The real challenge for the bricks store is to minimize frustration by moving as much purchasing into autopilot as possible, and spicing the mix with a limited amount of surprise and delight. Spice is good, but only in limited amounts. ;-)

Here's to GREAT "Shopping!"

Your friend, Herb Sorensen